Plus500 Review 2024

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Our thorough review of Plus500 reveals it as a standout option for forex and CFD traders, especially due to its competitive spread costs and robust platform offering. Based on our findings, we highly recommend it for those looking to diversify their trading strategies in a secure and user-friendly environment.

Overall Rating

Minimum Deposit

Trust Score

Pros and Cons

Pros

- Low Spreads: Offers lower-than-average spread costs on major pairs such as EUR/USD.

- Regulated Platform: Highly regulated by multiple financial authorities including ASIC, FCA, and MiFID.

- Proprietary Platform: Provides a robust proprietary platform tailored for efficient trading.

Cons

- Limited Platform Choices: Does not offer popular platforms like MetaTrader 4 or MetaTrader 5.

- No Copy Trading: Lacks options for copy and social trading.

- No Active Trader Discounts: Does not provide discounts for active retail traders.

Ratings Summary

- Investment Types - 8.0/10

- Commissions & Fees - 9.0/10

- Trading platforms - 8.5/10

- Research - 8.0/10

- Mobile Apps - 8.5/10

- Education - 7.0/10

- Overall - 8.6/10

Can I trust Plus500?

Plus500 (LSE: PLUS) is a publicly traded company and highly regulated by key financial authorities, including ASIC in Australia, MiFID in Europe, and the FCA in the UK. According to ForexBrokers.com, with a Trust Score of 99, Plus500 is considered highly trusted in the forex industry. Our review confirms its reliability and commitment to trader security.

Plus500 is currently licensed and/or authorised by the following regulatory bodies:

- Tier-1 Regulators - Financial Conduct Authority (FCA), Australian Securities & Investment Commission (ASIC), Japanese Financial Services Authority (JFSA), Financial Markets Authority (FMA), Monetary Authority of Singapore (MAS), and regulated in the European Union via the MiFID passporting system

- Tier-2 Regulators - Israel Securities Authority (ISA), Dubai Financial Services Authority (DFSA), and the Financial Sector Conduct Authority (FSCA)

- Tier-3 Regulators - None

- Tier-4 Regulators - Financial Services Authority (FSA)

Is Plus500 good for beginners?

Given Plus500's robust educational offerings and beginner-friendly educational videos, it is a suitable choice for novice traders. The platform provides comprehensive learning resources to help new traders understand forex and CFD trading effectively.

| Feature |

Plus500 Plus500

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | No |

Plus500 commissions and fees summary

Plus500's competitive edge is reinforced by its low average spread cost of 0.8 on the EUR/USD pair, below the industry average of 1.08. It is a cost-effective choice for most retail traders, but very active traders may prefer the discounts available from competitors.

| Feature |

Plus500 Plus500

|

|---|---|

| Minimum Deposit | €100 |

| Average Spread EUR/USD - Mini | N/A |

| Average Spread EUR/USD - Standard | N/A |

| All-in Cost EUR/USD - Active | N/A |

| Active Trader or VIP Discounts | No |

Plus500 trading platforms and tools

Did you know? Trading platforms comparison

Of the 60+ brokers reviewed on BrokerNotes, 64% offer a proprietary platform, 100% offer a web platform, 91% offer a desktop platform, 11% offer cTrader, 14% offer ZuluTrade, 81% offer MetaTrader 4, and 64% offer MetaTrader 5.

The proprietary trading platform offered by Plus500 is highly rated and recommended for traders seeking sophisticated, yet user-friendly trading tools. It aligns well with the needs of both novice and experienced traders.

Trading platforms offered: Plus500 offers a proprietary platform tailored for optimal trading performance.

Trading tools: The platform is equipped with advanced trading tools, enhancing trade execution and analysis.

Metatrader: Metatrader platforms are not available at Plus500.

Copy trading: Plus500 does not support copy trading.

| Feature |

Plus500 Plus500

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | Yes |

| Desktop Platform (Windows) | No |

| Web Platform | Yes |

| MetaTrader 4 (MT4) | No |

| MetaTrader 5 (MT5) | No |

| DupliTrade | No |

Plus500 trading platform screenshots

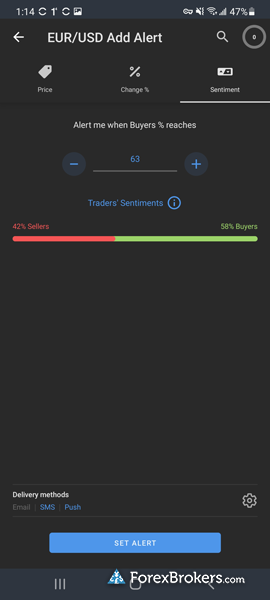

Mobile trading apps at Plus500

Plus500's mobile trading app is robust and recommended for traders who prioritize trading on the go. The app is well-designed, offering full functionality that mirrors its web browser counterpart.

| Feature |

Plus500 Plus500

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Economic Calendar | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Watchlist | Yes |

Plus500 mobile app screenshots

How do I open an account with Plus500?

To start trading with Plus500, follow these steps:

- Visit the Plus500 website and click on the "Start Trading" button.

- Fill out the registration form with your personal details.

- Verify your identity and address by uploading the required documents.

- Make your initial deposit using one of the supported payment methods.

- Begin trading once your account is set up and funded.

What can I trade at Plus500?

Plus500, including all of its subsidiaries, offers a diverse range of trading options, featuring 65 forex pairs and 5,500 tradeable symbols, significantly exceeding the industry average of 3,623 tradeable symbols. This extensive selection makes Plus500 an excellent platform for traders looking to explore various markets.

| Feature |

Plus500 Plus500

|

|---|---|

| Tradeable Symbols (Total) | 5500 |

| Forex Pairs (Total) | 65 |

| Social Trading / Copy Trading | No |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Spread Betting | No |

Plus500 research screenshots

Account funding at Plus500

Plus500 supports a variety of funding methods, including bank wires, PayPal, credit cards, and Skrill eWallet, although Neteller is not available.

| Feature |

Plus500 Plus500

|

|---|---|

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Neteller (Deposit/Withdraw) | No |

About Plus500

Plus500 was founded in 2008 and has established itself as a leading provider in the CFD market. The company is publicly traded on the London Stock Exchange (LSE: PLUS) and regulated by several major financial authorities, enhancing its reputation and reliability in the financial trading industry.

Popular Forex Guides

- Best CFD Trading Platforms of 2024

- Compare Forex and CFD Brokers

- Best Low Slippage Forex Brokers of 2024

- Best Zero Spread Forex Brokers of 2024

- Best PayPal Forex Brokers of 2024

- Best Forex Brokers of 2024

- Best Fixed Spread Brokers of 2024

- Best MT4 Brokers of 2024

- Best Institutional Forex Brokers of 2024

- Best Mac Forex Trading Platforms of 2024

- Best Forex Apps of 2024

- Best Copy Trading Platforms of 2024

- Best HFT Brokers of 2024

- Best Depth of Market Forex Brokers of 2024

- Best NinjaTrader Brokers of 2024

More Forex Guides

- Best Forex Micro Accounts

- Best Spread Betting Brokers of 2024

- Best Gold Trading Platforms of 2024

- Best Autochartist Forex Brokers of 2024

- Best Bitcoin Brokers of 2024

- Best Futures Brokers of 2024

- Best Forex Demo Accounts

- Best Silver Trading Platforms of 2024

- Best Scalping Forex Brokers of 2024

- Best Dow Jones Brokers of 2024

- Best MT5 Brokers of 2024

- Best Islamic Forex Brokers of 2024

Popular Forex Reviews

- IG Review

- Interactive Brokers Review

- FOREX.com Review

- IG Review

- IC Markets Review

- OctaFX Review

- All Broker Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

AI disclaimer

We use proprietary AI technology to assist in some aspects of our content production. However, our scores, ratings, and rankings of online brokers are based on our in-depth product testing and thousands of hand-collected data points. Learn more about our AI Policy and How We Test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.