Pepperstone Review 2024

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail CFD accounts lose money. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

In our thorough analysis, we find that Pepperstone is a highly recommended choice for forex and CFD traders, especially given its strong overall offering. The broker combines competitive spreads, robust regulatory oversight, and comprehensive educational resources, positioning it as a prime candidate for traders seeking reliability and extensive market access.

Overall Rating

Minimum Deposit

Trust Score

Pros and Cons

Pros

- Competitive Spreads: Average spread cost for the EUR/USD pair is notably low at 0.77.

- Regulatory Compliance: Fully authorized by ASIC, MiFID, and the FCA, ensuring high levels of trust and security.

- Third-party Platforms: Provides access to MetaTrader, cTrader, and others, providing a great selection of platforms especially for those interested in copy trading.

Cons

- Limited Forex Pairs: Offers 62 forex pairs, which might be less than some competitors.

- No Proprietary Platform: Does not offer a proprietary trading platform, which could be a drawback for some traders.

- Limited Tradeable Symbols: Offers 2342 tradeable symbols, below the industry average.

Ratings Summary

- Investment Types - 8.0/10

- Commissions & Fees - 9.0/10

- Trading platforms - 8.0/10

- Research - 8.5/10

- Mobile Apps - 7.5/10

- Education - 7.5/10

- Overall - 8.4/10

Can I trust Pepperstone?

Yes, Pepperstone earns our trust through multiple channels: it's authorized by major financial regulators including ASIC in Australia, MiFID in Europe, and the FCA in the UK. It holds a Trust Score rating of 95, indicating it as a highly trusted entity according to the forex industry research website ForexBrokers.com.

Pepperstone is currently licensed and/or authorised by the following regulatory bodies:

- Tier-1 Regulators - Australian Securities & Investment Commission (ASIC), Financial Conduct Authority (FCA), and regulated in the European Union via the MiFID passporting system

- Tier-2 Regulators - Central Markets Authority (CMA) and the Dubai Financial Services Authority (DFSA)

- Tier-3 Regulators - None

- Tier-4 Regulators - Securities Commission of the Bahamas (SCB) and the Financial Services Authority (FSA)

Is Pepperstone good for beginners?

Pepperstone is a splendid choice for beginners. With educational offerings that cater extensively to both beginners and advanced traders and a user-friendly approach to forex and CFD education, beginners are well-equipped to start their trading journey.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Education (Forex or CFDs) | Yes |

| Client Webinars | Yes |

| Videos - Beginner Trading Videos | Yes |

| Videos - Advanced Trading Videos | Yes |

| Investor Dictionary (Glossary) | Yes |

Pepperstone commissions and fees summary

Pepperstone offers competitive trading costs with an average EUR/USD spread of 0.77, well below the industry standard of 1.08. The broker does not impose inactivity fees and provides discounts for active or VIP traders, making its fee structure highly attractive for both casual and serious traders.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Minimum Deposit | $200 |

| Average Spread EUR/USD - Mini | 0.7 |

| Average Spread EUR/USD - Standard | 0.77 |

| All-in Cost EUR/USD - Active | 0.87 |

| Active Trader or VIP Discounts | Yes |

Pepperstone trading platforms and tools

Did you know? Trading platforms comparison

Of the 60+ brokers reviewed on BrokerNotes, 64% offer a proprietary platform, 100% offer a web platform, 91% offer a desktop platform, 11% offer cTrader, 14% offer ZuluTrade, 81% offer MetaTrader 4, and 64% offer MetaTrader 5.

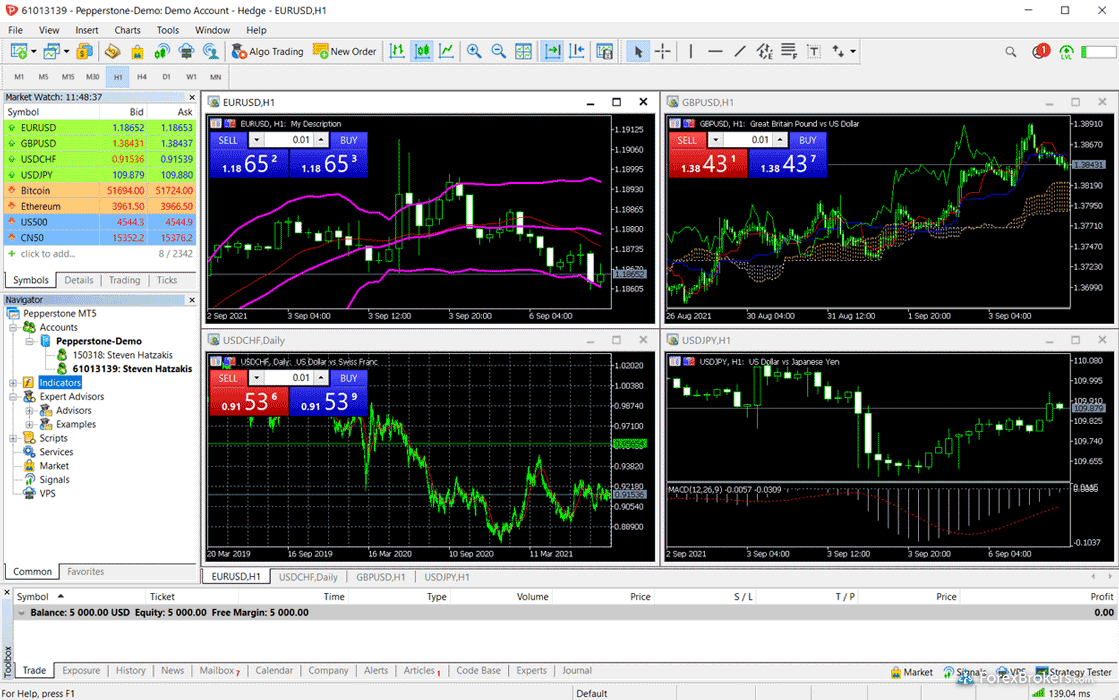

When it comes to trading platforms and tools, Pepperstone provides a solid lineup that meets the needs of most traders. With support for popular platforms like MetaTrader 4, MetaTrader 5, and cTrader, traders have access to robust trading tools and customizable interfaces. Our evaluation of Pepperstone's platforms and tools found them to be highly competitive, although just shy of the highest accolade, making them suitable for most trading strategies.

Trading platforms offered: Pepperstone offers MetaTrader 4, MetaTrader 5, and cTrader, which are among the most widely used platforms in the forex community. However, it does not offer a proprietary platform.

Trading tools: The broker provides a range of trading tools that enhance analytical capabilities and trading efficiency.

Copy trading: Pepperstone supports numerous copy trading platforms, enabling traders to replicate the positions of experienced traders automatically.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Virtual Trading (Demo) | Yes |

| Proprietary Platform | No |

| Desktop Platform (Windows) | Yes |

| Web Platform | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | Yes |

| DupliTrade | Yes |

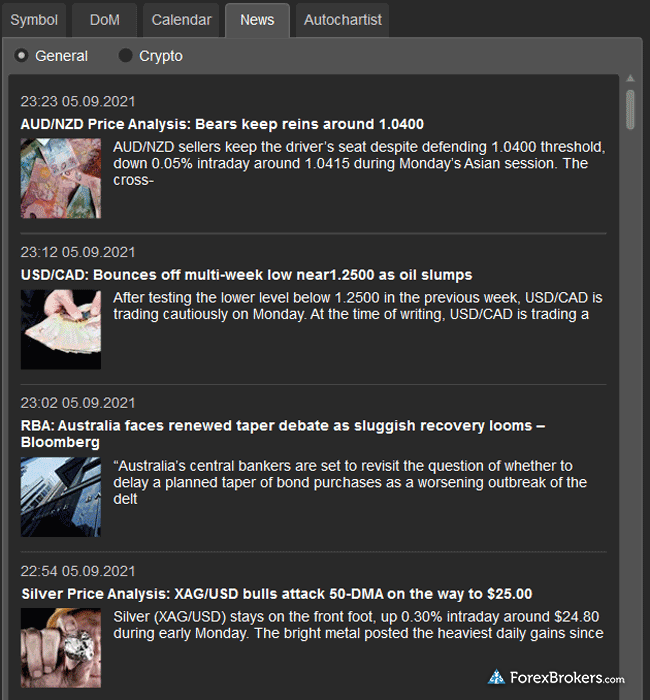

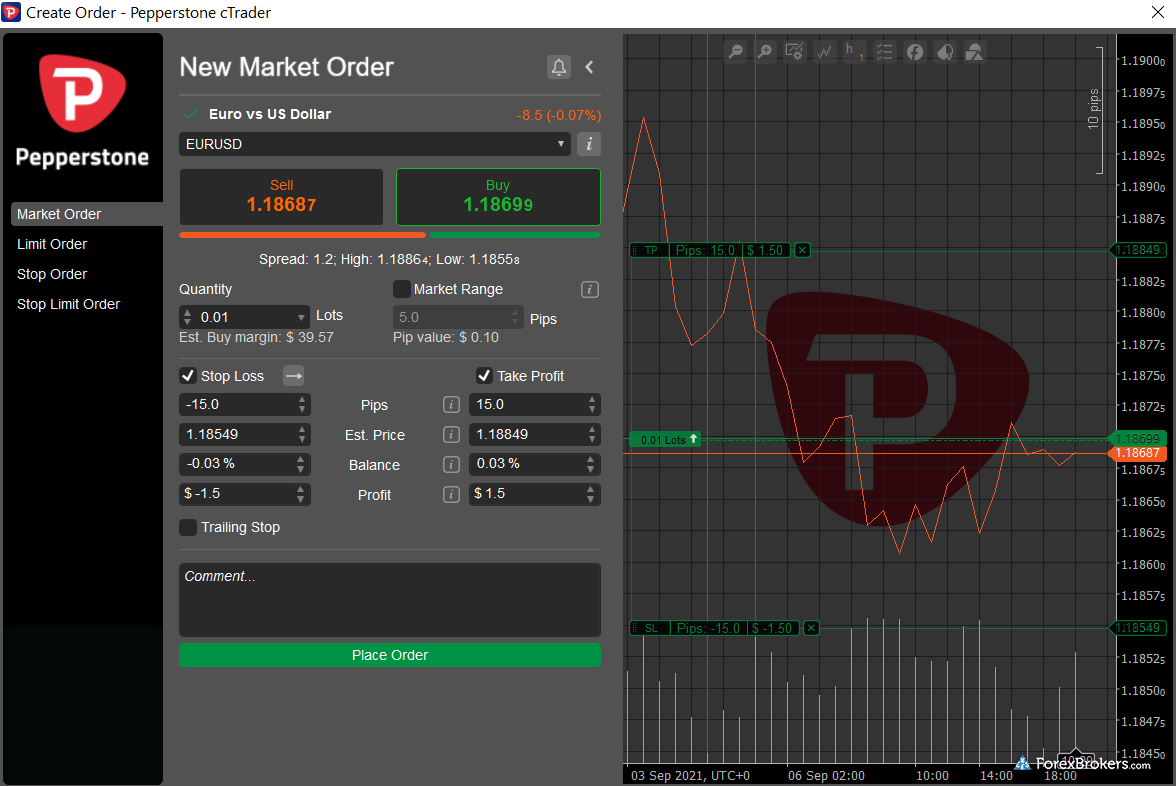

Pepperstone trading platform screenshots

Mobile trading apps at Pepperstone

Pepperstone provides highly effective mobile trading applications, allowing traders to execute trades and monitor markets conveniently from their smartphones or tablets.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Android App | Yes |

| Apple iOS App | Yes |

| Mobile Economic Calendar | Yes |

| Mobile Alerts - Basic Fields | Yes |

| Mobile Charting - Draw Trendlines | Yes |

| Mobile Watchlist | Yes |

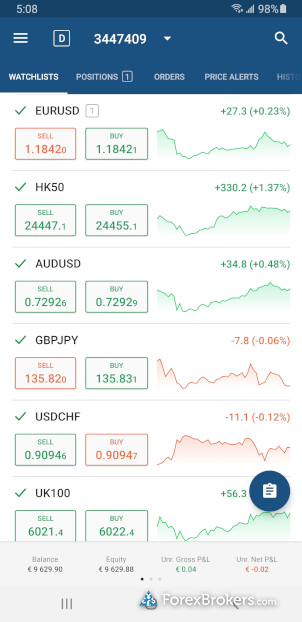

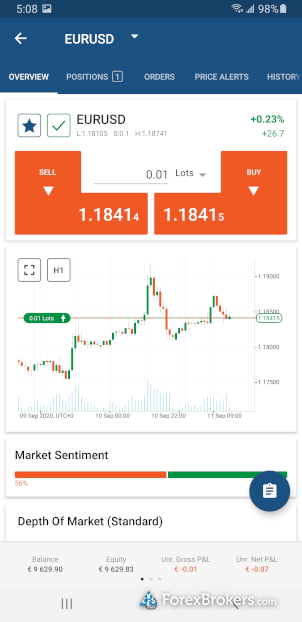

Pepperstone mobile app screenshots

How do I open an account with Pepperstone?

Opening an account with Pepperstone is a straightforward process designed to get you trading as quickly as possible. Here's how you can start:

- Visit the Website: Go to Pepperstone's official website and click on the 'Start Trading' or 'Open Account' button.

- Fill Out the Application: Complete the online application form, which includes providing some personal information, financial background, and trading experience.

- Verify Your Identity: To comply with regulatory requirements, you'll need to verify your identity by submitting documents such as a government-issued ID.

- Fund Your Account: Once your account is verified, you can fund it using one of the several methods available such as bank wires, credit cards, or e-wallets like PayPal or Skrill.

- Start Trading: After your account is funded, you're ready to start trading. You can also access educational resources and trading tools to enhance your trading experience.

What can I trade at Pepperstone?

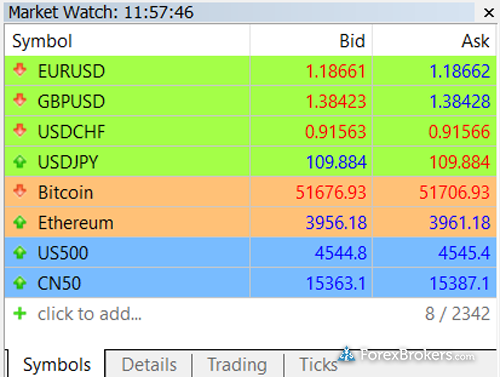

Pepperstone allows trading in 62 forex pairs and 2342 different tradeable symbols. Although this is less than the industry average, it offers sufficient variety for most traders to engage effectively in forex and CFD markets.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Tradeable Symbols (Total) | 2342 |

| Forex Pairs (Total) | 62 |

| Social Trading / Copy Trading | Yes |

| Cryptocurrency (Physical) | No |

| Cryptocurrency (Derivative) | Yes |

| Spread Betting | Yes |

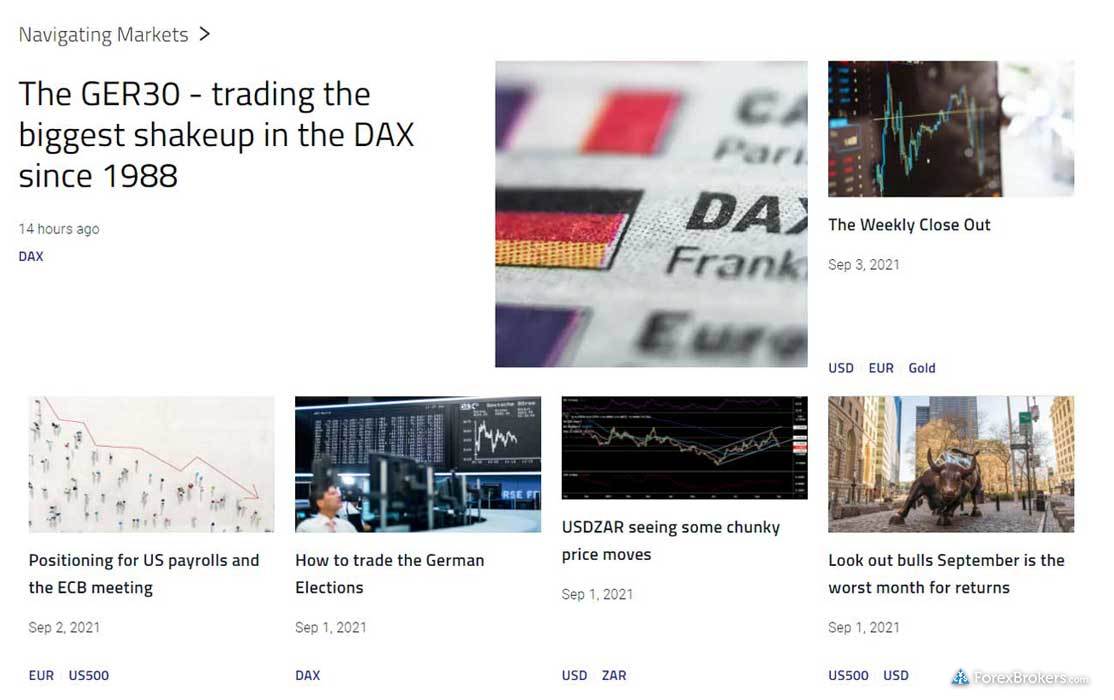

Pepperstone research screenshots

Account funding at Pepperstone

Pepperstone supports a variety of funding methods, enhancing the convenience for traders globally.

| Feature |

Pepperstone Pepperstone

|

|---|---|

| Visa/Mastercard (Credit/Debit) | Yes |

| Bank Wire (Deposit/Withdraw) | Yes |

| PayPal (Deposit/Withdraw) | Yes |

| Skrill (Deposit/Withdraw) | Yes |

| Neteller (Deposit/Withdraw) | Yes |

About Pepperstone

Pepperstone, founded in 2010, has grown rapidly to become a leading forex and CFD broker. Known for its commitment to low-cost trading, advanced technology, and strong regulatory oversight, the broker provides a trustworthy and efficient trading environment. Operating under regulation from top-tier authorities like ASIC, FCA, and MiFID, Pepperstone maintains a high standard of safety and transparency, making it a preferred choice for traders around the world.

Popular Forex Guides

- Best Depth of Market Forex Brokers of 2024

- Best Forex Apps of 2024

- Best Fixed Spread Brokers of 2024

- Best Mac Forex Trading Platforms of 2024

- Best Zero Spread Forex Brokers of 2024

- Best CFD Trading Platforms of 2024

- Best PayPal Forex Brokers of 2024

- Best HFT Brokers of 2024

- Compare Forex and CFD Brokers

- Best NinjaTrader Brokers of 2024

- Best Low Slippage Forex Brokers of 2024

- Best Copy Trading Platforms of 2024

- Best MT4 Brokers of 2024

- Best Institutional Forex Brokers of 2024

- Best Forex Brokers of 2024

More Forex Guides

- Best Bitcoin Brokers of 2024

- Best Forex Micro Accounts

- Best Gold Trading Platforms of 2024

- Best Spread Betting Brokers of 2024

- Best Scalping Forex Brokers of 2024

- Best Autochartist Forex Brokers of 2024

- Best Futures Brokers of 2024

- Best Silver Trading Platforms of 2024

- Best Dow Jones Brokers of 2024

- Best Forex Demo Accounts

- Best Islamic Forex Brokers of 2024

- Best MT5 Brokers of 2024

Popular Forex Reviews

- IG Review

- Interactive Brokers Review

- FOREX.com Review

- IG Review

- IC Markets Review

- OctaFX Review

- All Broker Reviews

Methodology

At BrokerNotes.co, our data-driven online broker reviews are based on our extensive testing of brokers, platforms, products, technologies, and third-party trading tools. Our product testing extends to the quality and availability of educational content, market research resources, and the accessibility and capabilities of mobile platforms and trading apps. We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser. Our Desktop PCs run Windows 11, and we use MacBook Pro laptops running the latest version of macOS to test trading on the go. We test mobile apps and products using iPhones running iOS 17 and Samsung devices running Android OS 14.

Note: The online brokers on our site provide the ability to trade forex in one or more ways, such as non-deliverable spot forex (i.e., rolling spot contracts), contracts for difference (CFD), or other derivatives such as futures. The availability of specific markets or features will depend on your country of residence and the broker's applicable brand or entity that services your account(s).

AI disclaimer

We use proprietary AI technology to assist in some aspects of our content production. However, our scores, ratings, and rankings of online brokers are based on our in-depth product testing and thousands of hand-collected data points. Learn more about our AI Policy and How We Test.

Forex Risk Disclaimer

There is a very high degree of risk involved in trading securities. With respect to margin-based foreign exchange trading, off-exchange derivatives, and cryptocurrencies, there is considerable exposure to risk, including but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or related instrument. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Learn more about foreign exchange risk.